Go ahead...spend it like you mean it!

With Daily Checking, you get easy access to everything you need for your daily buys like groceries, coffee, gas, and whatever else you're into. Plus, there's no worries about any pesky monthly maintenance fees eating into your balance. Your money is yours to spend, or save, for yourself!

Everything you need:

- Easy payment options with your Debit Mastercard®

- Get paid up to two days early with Early Pay1

- Send and receive money with Zelle® 3

And nothing you don't need:

- No monthly service fee regardless of your balance

- Plus, you can skip the ATM fees2

Turn small spends into big wins!

With Members Choice Daily Checking, you get more cash in your pocket, making it easier to budget and save up for the things you really want. And since there are no monthly fees, no direct deposit needed, and no minimum balance, you can spend without any stress.

Get these benefits with Daily Checking

- No monthly maintenance fee

- Overdraft protection up to $600 with Choice Pay

- Debit Mastercard®

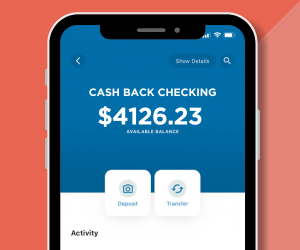

- Mobile and online banking

- Mobile wallet

- EZSwitch Direct Deposit

- Bill Pay

- eAlerts & eStatements

- Unlimited check writing

- Send and receive money with Zelle®

- Access to over 55,000 ATMs worldwide

- ATM fee refunds (Members Choice and Foreign) up to $25/month

Have questions for one of our representatives?

Fill out the short form below to hear back within the next business day.

Are you ready to get rewarded?

Open a Daily Checking Account Online

General requirements

- No minimum deposit to open

- No minimum balance requirement

- No direct deposit requirement

- eStatements only

|

Why You'll Love Zelle®

|

FAQs about Daily Checking

Zelle® is a fast and convenient way to electronically send and receive money with friends, family and others you trust, even if they bank somewhere different than you. You can use Zelle® to do things like gift people money, pay the sitter, or split the cost of a night out with friends. Zelle® is accessible for members with Members Choice Complete Checking®, Daily Checking and Student Saver Checking, and is available in your online and mobile banking account.

How do I enroll in Zelle®?

Step 1: Log in to the MCCU Houston TX app.

Step 2: In the main menu, select "Transfer and Pay". Then "Zelle®".

Step 3: Enroll your email address or U.S. mobile number.

How can I access Zelle®?

You can send, request, or receive money with Zelle®. To get started, log into the MCCU Houston TX app or online banking. In the main menu, select "Transfer and Pay". Then "Zelle®".

How do I use Zelle®?

To send money using Zelle®, simply select someone from your mobile device's contacts (or add a trusted recipient's email address or U.S. mobile number), add the amount you'd like to send and an optional note, review, then hit "Send." The recipient will receive an email or text message notification via the method they used to enroll with Zelle®. Money is available to your recipient in minutes if they are already enrolled with Zelle®.

To request money using Zelle®, choose "Request," select the individual from whom you'd like to request money, enter the amount you'd like, include an optional note, review and hit "Request". If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile number.

To receive money, just share your enrolled email address or U.S. mobile number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Members Choice Credit Union account, typically within minutes.

If someone sent you money with Zelle® and you have not yet enrolled with Zelle®, follow these steps:

-

Click on the link provided in the payment notification you received via email or text message.

-

Select Members Choice Credit Union.

-

Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification—you should enroll with Zelle® using that email address or U.S. mobile number to ensure you receive your money.

- You recently set up direct deposit for the first time

- Your deposit type is not eligible, such as a bank-to-bank transfer

- There’s a payroll system issue from your payer

- You reached the transaction limit or monthly deposit dollar limit for early processing

- Early direct deposits also depend on timing—your payer must provide payment details on time so the deposit can process early. If your deposit doesn't arrive early, expect it to arrive on your scheduled payday

- Login to online banking

- Select eDocs from the Accounts menu

- Select the Delivery Preference you would like to change – either all accounts or just select accounts

- Select save

- Review and accept to the site terms

Set up direct deposit to your checking/savings account for a reliable and convenient way to get paid.

Direct deposit of your payroll, social security or other regular payment can be an effective way to help you budget and protect against identity theft, even while you are away.

EZSwitch Direct Deposit

This is the fast and easy way to setup direct deposit right from your online or mobile banking. Plus, you don't need to reach out to your payor or HR department. Sets up in minutes!

Direct Deposit from your employer

Contact your payor and request to have your payroll check automatically deposited into your Checking/Savings account. Use your member account number to complete the process. Your employer may request this information to set up direct deposit for your regular payroll check:

- Credit Union Name: Members Choice Credit Union – Houston, TX

- Type of account: (checking or savings)

- Routing / ABA number: 313083196

- Account number: Your checking or savings account number - access by logging in to online banking. Here are the steps to find that number:

-

- Go to mccu.com

- Enter your username and password in Account Logins, then click Login

- Once you are in online banking, select the Accounts widget

- Select the checking or savings account you would like to use

- Select Account Details, then locate the full MICR Account Number (13 digits)

Use MyPay if your direct deposit originates from:

- Active Duty Military Service Pay

- Reserve Military Pay

- Military Retirement Pay

- Department of Defenses (DoD) Pay

- Defense Finance and Accounting Services Pay

Use Standard Form 1199A or Go Direct if your direct deposit originates from the United States Treasury for:

Disclosures

In order to receive the additional benefits as described herein for a particular monthly qualification cycle, you must receive monthly eStatements for the account. Rates may change at any time without notice, before or after the account is opened. Fees could reduce earnings on the account. Minimum opening balance is $0. View complete list of deposit disclosures and Fee Schedule.

2 ATM Fee Rebates: For any Daily Checking account, if you have met your qualifications during the monthly qualification cycle, we will reimburse you for ATM fees imposed during the monthly qualification cycle by our institution and other U.S. financial institutions. The maximum ATM fee rebate is $25 for one qualification cycle. ATM fee rebates will be transferred to the checking account. If you believe that you have not been reimbursed the correct amount, please contact us. We must hear from you no later than 30 days after the statement cycle when the reimbursement was applicable.